02/2021 Pre Close Period Trading Update

Associated British Foods plc issues the following update prior to entering the close period for its interim results for the 24 weeks to 27 February 2021, which are scheduled to be announced on 20 April 2021. It also includes the likely timetable for the reopening of those Primark stores which are currently closed and our trading experience in those stores recently reopened.

Trading outlook

For the first half of 2021 we expect revenue and profit in each of our Grocery, Sugar, Agriculture and Ingredients businesses to be ahead of both expectation and the first half of last year.

Our Retail performance in the first half was materially impacted by the restrictions on movement of people and of trading activity put in place by the UK and European governments. Our estimate for the loss of sales in the periods of store closures during this period is £1.1bn. When stores were open demand was strong and trading was encouraging, given the circumstances. We expect Primark sales in the first half to be some £2.2bn and the adjusted operating profit to be marginally above break-even.

As a consequence of the restrictions placed on Primark we expect sales, adjusted operating profit and adjusted earnings per share for the group to be lower than last year. The lower profitability of Primark will result in an increase in the group’s effective tax rate this year to some 30%.

The weighted average exchange rate for sterling against our major trading currencies was in line with that for the comparable period last financial year and there will be a translation gain of some £3m in the period.

We are looking forward to the reopening of the Primark estate. As of today, we have likely reopening dates for 233 stores in addition to the 77 stores already open, so that 83% of our retail selling space should be trading by 26 April. Our stores will be offering exciting seasonal ranges for spring/summer and we have been placing orders for merchandise with a long lead time for the autumn/winter season. We expect the period after reopening to be highly cash generative.

Cashflow and funding

The group’s net cash before lease liabilities is now expected to be some £650m at the half year. The improvement since our last trading update is primarily driven by lower working capital requirements in all our businesses.

The cash outflow for the group in the first half is expected to be some £900m. We normally have a seasonal outflow in this period for our Sugar businesses in the northern hemisphere and payment was made for those orders for Primark’s autumn/winter ranges which were delayed from the last financial year. The major part of this outflow, which we estimate to be some £650m, is a result of the Primark store closures. This relates to both the loss of revenue, whilst most stores were closed during November and since the end of December, and the consequent increase in stocks.

The group’s net cash before lease liabilities of some £650m at this half year compares to £801m at the same time last year. The cash outflow as a result of the periods for which Primark’s stores were closed over the last year has been substantially offset by the higher cash generation by our food businesses and by the non-payment of both interim and final dividends for our 2020 financial year.

Retail

Primark’s sales for the half year are estimated to be some £2.2bn, compared to £3.7bn in the first half of the last financial year. This period has been characterised by the impact on our trading of the restrictions on the movement of people put in place by UK and European governments to limit the spread of COVID-19. The extent and timing of restrictions have varied by market, with different approaches taken by each government and during this first half, unlike the first lockdown, all of our stores have not been closed at the same time. However, the majority of our stores were closed during November and from the end of December and we estimate the loss of sales while stores were closed to be some £1.1bn.

When stores were open, trading continued to be strong, with sales at -15% on a like-for-like basis compared to last year. This performance should be seen in the context of lower category spend and lower footfall reflecting government advice to limit journeys from home. Furthermore our hours of trading have been restricted, for example closure at the weekends in Italy and early closing in Spain, even where stores are open. Performance has varied by store reflecting the prevailing circumstances of our customers including home working, less commuting and very little tourism. Like-for-like sales at our stores in retail parks were higher than a year ago, shopping centre and regional high street stores were lower than last year, and large destination city centre stores, which are heavily reliant on tourism and commuters, continue to see a significant decline in footfall. Excluding our 16 major city centre stores, trading was at -11% on a like-for-like basis.

Our business in the US continued to perform well, with particularly strong trading at recently opened stores, American Dream, New Jersey and Sawgrass Mills, Florida.

Sales in those stores open during the festive season reflected the excitement and broad appeal of the Primark offering. All Christmas and gifting lines were sold out and the performance for “stay at home” product categories was strong, especially in nightwear and loungewear. The level of markdown was substantially lower than the same period last year. We now expect to warehouse some £260m of autumn/winter stock for later this year. All orders placed with our suppliers will be honoured.

We have implemented operational plans to manage the consequences of the closures. As a result, overhead costs have been partially mitigated with some 25% of operating costs of the closed stores being saved during the period.

We expect the adjusted operating profit for Primark in the first half to be marginally above break-even, but which would compare to an adjusted operating profit of £441m for the same period in the last financial year.

Retail selling space has increased by 0.3m sq ft since the last financial year end and at 27 February 2021, we will have 390 stores with 16.5m sq ft of retail selling space which compared to 15.8m sq ft a year ago. Six new stores were opened in the period, with the latest store opening in Coquelles near Calais in France adding to Barcelona Sant Cugat and Espacio León in Spain, Sawgrass Mills Florida and American Dream New Jersey in the US and Roma Maximo in Italy. In addition, we relocated to larger premises in Southend UK. The very positive customer reaction to these store openings, both in the US and in Europe, was striking.

We expect to add a net 0.7m sq ft of additional selling space in this financial year. We plan to open 15 new stores for the year: five in Spain, three in the US, two in Italy, one in each of the UK, France and the Netherlands, our next store in Poland, Poznan, and our first store in Czechia/Czech Republic, Prague.

Looking further ahead, we continue to add to the pipeline of new stores. Further to the lease signed for a store in Queens, New York, we have now signed a lease for a store in Green Acres Mall in Long Island, New York. We are excited about the growth opportunity for the brand in the US. In addition, we have also recently signed leases for Girona, Cadiz and San Sebastien in Spain, Catania in Italy, Rouen Saint Server in France and Katowice in Poland.

In the markets where Primark operates governments have been announcing plans to ease, or have started to ease, restrictions on clothing retailing. Over the last few weeks our stores in Austria, Poland and Slovenia have already re-opened and trading has been very strong. Sales in these stores were ahead of last year on a like-for-like basis. Customer demand was particularly strong for children’s wear, nightwear and loungewear. Safety continues to be our highest priority with measures, developed across our UK and European estate, designed to safeguard the health and wellbeing of everyone in store and instill confidence in the store environment.

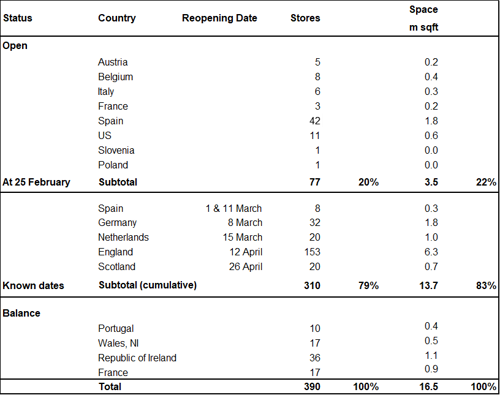

As at today, Primark is trading in 77 stores which represent 22% of our retail selling space.

Current plans anticipate the following reopenings subject to relevant local criteria: six Spanish stores on 1 March and two on 11 March, 32 stores in Germany on 8 March and 20 stores in the Netherlands on 15 March. Following the announcement by the UK Government on the 22 February the reopening of the 153 stores in England is likely on 12 April. The table below sets out those Primark stores that have already reopened, those with a confirmed reopening date and the remaining stores where we still await confirmation.

Our estimate for the sales which will be lost during the second half of our financial year in respect of the remaining periods of store closures is some £480m, with a loss of contribution, after cost mitigation, of £170m.

We are looking forward to the reopening of all of our estate and we will ensure that our stores will offer exciting seasonal range for spring/summer. Importantly we have been placing orders for merchandise with a long lead time for the autumn/winter season.

We expect the period after reopening to be very cash generative. We expect to sell the £150m of spring/summer inventory held over from last year and our cash outlay in the second half for the coming autumn/winter season will mostly benefit from the £260m autumn/winter stock held over from the first half.

Sugar

AB Sugar revenue is expected to be marginally ahead of last year in the first half primarily due to higher average sugar prices for British Sugar and higher prices in Illovo. Operating profits are expected to be significantly ahead for the half year driven by a strong recovery in Illovo and further improvement in British Sugar. Along with the benefit of these higher prices, Illovo has also benefited from increased domestic and regional sales and all businesses continued to deliver savings from the performance improvement programme.

We expect that UK sugar production for the 2020/21 campaign will be 0.9m tonnes, well down on last year's 1.19m tonnes, due to wet weather conditions at the time of planting and the severe impact of virus yellows, which is transmitted by aphids, on the sugar beet. On 8 January the UK Government granted a conditional permit for the emergency use of neonicotinoids as a seed treatment for the 2021/22 beet growing season. An independent scientific assessment is likely to predict low aphid population levels as a result of prolonged cold temperatures this February and as a consequence it is unlikely that neonicotinoids will be deemed necessary. We continue to work to secure a pesticide-free long-term solution in partnership with sugar beet growers and seed producers.

The UK Department for Transport has announced an increase in the mandated inclusion levels of renewable ethanol in petrol, moving from a nominal 5% inclusion, E5, up to a nominal 10% inclusion, E10. Having worked with the Department for Transport, we now plan to re-open the Vivergo facility in Hull which uses domestic feed grade wheat to produce bioethanol. Supply to UK fuel blenders is expected from early 2022.

In Spain, revenue in the first half is expected to be in line with last year. Sugar production is also expected to be in line with last year. The beet campaigns have progressed successfully in the north and the area planted in the south was ahead again this year and the volume of raw sugar refined at the Guadalete facility is underway and aligned with last year.

At Illovo, margins are expected to be well ahead of last year. Significant cost reductions from the performance improvement programmes and a recovery from operational difficulties in Mozambique last year were major contributors. Margins also benefited from higher prices, higher sales into domestic and regional markets, and lower export sales. Some recovery of prices benefited revenue in Zambia and export sales benefited from the higher world sugar price.

The campaign in China has now been completed with sugar production ahead of last year. Although revenue is expected to be lower in the first half, with reduced sales ahead of Chinese New Year, the profit impact has been offset by strong factory performances.

For the full year, our expectation remains for operating profit to be well ahead of last year with the major driver being the strong recovery in Illovo. We expect nonetheless a softer performance in the second half compared to last year with the earlier profit phasing by Illovo this year and the start-up costs for Vivergo now included in the second half.

Grocery

Revenue in the first half is expected to be 7% ahead of last year at both actual and constant currency. Adjusted operating profit is expected to be ahead, with strong performances by Twinings Ovaltine and our UK Grocery businesses more than offsetting lower margins in the Don meat business in Australia and the Mazola vegetable oil business in the US.

The performance of Twinings Ovaltine reflected the changes in consumption patterns as a result of COVID-19. Retail and online sales increased but on-the-go and foodservice volumes continued to be adversely affected in this period. We expect very strong revenue growth for Ovaltine, driven by South East Asia, and in particular in Thailand. Twinings revenue will be ahead of last year, driven by growth in herbal and fruit infusions with a very strong performance in France, delivering a significant improvement in market share.

Silver Spoon, Jordans, Dorset Cereals, Ryvita, Patak’s and Blue Dragon all delivered growth as they benefited from significant increases in consumer demand through the retail channel. Revenue in Allied Bakeries will be in line with last year and a cost reduction programme will be implemented this year to mitigate the contribution loss following our decision last year to exit the Co-op contract.

Profit at ACH will decline with significantly higher corn oil costs and lower corn oil availability reducing the contribution from Mazola. However, our baking businesses, ACH Mexico and Anthony’s Goods continued to deliver profit growth. Lower foodservice and retail volumes in the Don meat business impacted the profitability of George Weston Foods in Australia. Both Tip Top and Yumi’s will deliver strong growth.

Agriculture

Revenue and profit at AB Agri are expected to be ahead of last year in the first half. Our business in China will deliver a significant improvement with earlier phasing of sugar beet feed sales, the benefit of cost improvement projects and strong feed sales into the pig market. The pig population in China is now increasing strongly as it recovers from the effects from African Swine Fever. AB Neo, our business which specialises in feed for animals in the early stages of life, delivered an improved margin with an increase in sales volumes in Spain and Poland and the benefits of better procurement.

ABN, our UK pig and poultry animal feed business, is planning to build a state-of-the-art animal feed mill in the East of England as part of an on-going investment programme. The investment aims to provide a sustainable solution for increasing demand from an industry currently close to capacity.

Ingredients

Revenue in the first half is expected to be ahead of last year at constant currency. Margin will be significantly ahead driven both by AB Mauri and ABF Ingredients.

AB Mauri benefited from increased demand for retail yeast and retail bakery ingredients as the restrictions to contain the spread of COVID-19 continued to support the popularity of home baking. This has contributed to revenue increases in the retail channel particularly in the Americas, Europe, China, and parts of Asia. The business performance in South America has been resilient despite difficult economic conditions. In Brazil the business has benefited from increased demand in baking.

For ABF Ingredients, we expect strong revenue growth from our speciality lipids business, ABITEC, and from our yeast extract business, Ohly. Margin will benefit from increased sales of high value products.

Brexit

Our businesses were well prepared for the end of the Brexit transition period and we have seen no material disruption to our supply chains.

ESG

The group intends to hold the first of a series of investor events, setting out its approach to Environmental, Social and Governance (ESG) factors on Monday 1 March.

For further enquiries please contact:

Associated British Foods

John Bason, Finance Director

Catherine Hicks, Corporate Affairs Director

Tel: 020 7399 6500

Citigate Dewe Rogerson

Chris Barrie, Jos Bieneman

Tel: 020 7638 9571

Note:

Definitions of the alternative performance measures referred to in this announcement can be found in note 30 of our Annual Report and Accounts 2020.